Key Takeaways

- Microsoft Copilot integrates AI with Microsoft tools to enhance productivity, decision-making, and compliance in financial services.

- Automates repetitive tasks, improves customer personalization, and ensures regulatory adherence.

- Empowers financial institutions to stay competitive in a rapidly evolving industry.

Introduction

The global generative AI market in finance is forecast to increase at a compound annual growth rate of 28.1 percent between 2023 and 2032, rising from 1.09 billion U.S. dollars in 2023 to 9.48 billion U.S. dollars in 2032. Among the leading solutions, Microsoft Copilot is a transformative AI tool designed to streamline operations, enhance decision-making, and improve customer experiences. By leveraging Microsoft Copilot, financial institutions can automate complex workflows, reduce risks, and unlock new efficiencies, positioning themselves for sustained growth.

What is Microsoft Copilot?

Microsoft Copilot is an enterprise-grade AI assistant that integrates seamlessly with Microsoft’s ecosystem, including Dynamics 365, Power BI, and Microsoft 365. Powered by advanced language models, Copilot enhances productivity by generating insights, automating tasks, and facilitating collaboration. With its AI-driven capabilities, Copilot aids in transforming traditional processes into intelligent, data-driven workflows tailored for financial services.

Key features include:

- Data Insights: Offers real-time analytics and predictions.

- Task Automation: Eliminates repetitive tasks like document creation and data entry.

- Collaboration: Enhances team productivity through AI-driven suggestions in tools like Teams and Outlook.

How Might Adoption of Microsoft Copilot Benefit a Financial Services Organization?

In an era where agility and efficiency define success, Microsoft Copilot studio consulting services emerge as a transformative tool for financial services organizations. By leveraging its AI-powered capabilities, businesses in this sector can streamline operations, enhance decision-making, and deliver superior customer experiences. Here’s how Microsoft Copilot can revolutionize financial services:

1. Enhanced Decision-Making with AI-Powered Insights

Financial institutions rely on vast volumes of data to drive decisions. Microsoft Copilot integrates with tools like Power BI and Dynamics 365 to analyze this data in real time. Whether predicting market trends, assessing credit risk, or optimizing portfolio strategies, Copilot delivers actionable insights to enable data-driven decisions.

For example:

- Risk analysis models assess loan applications and flag high-risk profiles.

- Investment teams receive up-to-the-minute data visualizations for smarter portfolio adjustments.

2. Increased Operational Efficiency

The financial sector is laden with repetitive tasks, from generating reports to reconciling financial statements. Microsoft Copilot automates these workflows, freeing employees to focus on strategic initiatives.

Examples include:

- Auto-generation of compliance reports.

- Streamlined invoice processing and auditing.

By automating these processes, organizations reduce errors and improve turnaround times, leading to significant cost savings.

3. Superior Customer Experience

Personalization is key to retaining customers in competitive markets. Microsoft Copilot uses AI to tailor customer interactions based on transaction history, preferences, and behavior.

Applications:

- Personalized financial advice for clients.

- Real-time responses to customer queries through AI-powered chatbots integrated into customer service platforms like Microsoft Teams.

This level of personalization strengthens relationships and drives customer loyalty.

4. Streamlined Regulatory Compliance

Navigating complex regulations is a constant challenge for financial firms. Microsoft Copilot simplifies compliance by automating the creation of accurate documentation and monitoring processes for adherence to legal standards.

Key benefits include:

- Real-time alerts for regulatory discrepancies.

- Simplified reporting for audits and legal reviews.

By ensuring compliance, Copilot mitigates risks and builds trust with stakeholders.

5. Scalability for Growing Demands

As financial organizations expand, scalability becomes crucial. Copilot’s cloud-based infrastructure allows businesses to scale operations without significant infrastructure investments.

For instance:

- Growing customer bases can be managed effectively with automated workflows.

- Data-heavy processes like fraud detection and transaction analysis can scale seamlessly with increasing workloads.

6. Strengthened Collaboration Across Teams

Financial organizations often have siloed teams working on interdependent tasks. Copilot fosters collaboration by integrating with Microsoft 365 apps like Teams, Excel, and SharePoint.

Benefits:

- Cross-departmental data sharing for a unified approach to client management.

- Simplified project tracking with real-time updates.

This interconnectedness enhances productivity and ensures consistent communication across departments.

7. Future-Proofing with AI Integration

The financial industry evolves rapidly, and staying competitive requires innovative tools. Microsoft Copilot’s ability to learn and adapt ensures businesses remain ahead of trends.

Examples of future-proofing:

- Predictive models that evolve with changing market conditions.

- Integration of new AI capabilities for enhanced financial forecasting.

Use Cases of Copilot in Financial Services

- Risk Management and Compliance

- Automates the generation of audit reports and regulatory filings.

- Flags anomalies in financial data for proactive risk mitigation.

2. Customer Insights and Personalization

- Analyzes transaction patterns to deliver tailored financial solutions.

- Enhances customer support through AI-driven chatbots and real-time assistance.

3. Fraud Detection

- Detects unusual transaction behaviors using predictive analytics.

- Reduces fraud risks through continuous monitoring of financial activities.

4. Strategic Financial Planning

- Provides executives with dashboards summarizing performance metrics.

- Simulates financial scenarios to guide investment decisions.

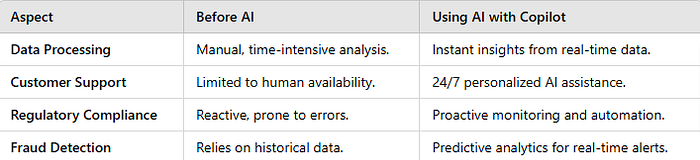

Transforming Financial Services: Before AI vs. Using AI

Conclusion

Microsoft Copilot is redefining financial services by combining AI innovation with Microsoft’s trusted tools. From automating processes to enhancing decision-making and improving compliance, its capabilities empower organizations to navigate the complexities of the financial landscape efficiently. For businesses looking to stay competitive, adopting AI solutions like Microsoft Copilot is no longer optional — it’s essential for transformation and growth.