The global smart lighting market was valued at USD 15.05 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 22.1% from 2023 to 2030. The rising demand for smart lighting is primarily attributed to its ability to connect with Internet of Things (IoT) devices and create customizable ambient lighting that can be controlled through smartphones or tablets. Smart lighting systems offer features such as dimmability, a range of color tones, scheduling capabilities for turning lights on and off, energy usage monitoring, and various connectivity options including Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee. Furthermore, these lights can be operated via voice commands when integrated with platforms like Google Assistant, Amazon Alexa, Apple Siri, or Microsoft Cortana. The combination of these features, alongside the growing adoption of IoT devices and smart assistant technologies, has opened up significant avenues for market growth in the smart lighting sector.

Gather more insights about the market drivers, restrains and growth of the Global Smart Lighting Market

Smart lighting, often referred to as connected lighting, is designed for seamless integration into a building’s IT network or urban infrastructure, enabling it to share operational status information. For example, smart street lights in urban areas enhance safety by providing extensive coverage and enabling environmental monitoring, parking management, traffic management, and city surveillance through IoT connectivity. These systems are frequently equipped with sensors that transform them into intelligent devices capable of gathering data on activity patterns, daylight levels, occupancy, temperature fluctuations, and humidity. This data is crucial for government agencies to monitor and respond to urban activity effectively.

Challenges to Adoption

Despite the positive outlook, the total cost of ownership for smart lighting encompasses both direct and indirect expenses incurred throughout the product lifecycle. This includes costs related to equipment, installation, deployment, operation, upgrades, and maintenance. Smart lights consist of various components, such as sensors, control systems, dimmers, switches, and software, which can lead to higher initial costs compared to conventional lighting solutions. Consequently, this may deter some residential customers and budget-conscious users from adopting smart lighting technologies, potentially limiting market growth.

Additionally, compatibility issues with existing infrastructure can arise, as smart lights often differ in form factor and circuitry from traditional fixtures. This may necessitate replacing existing switches, and not all smart lighting fixtures are compatible with all traditional fittings. For instance, while LED bulbs generate less heat than incandescent bulbs due to their heat sink design, enclosing LED bulbs in tightly sealed fixtures can hinder effective heat dissipation, potentially reducing their lifespan. Such compatibility challenges may further restrain market growth.

Segmentation Analysis:

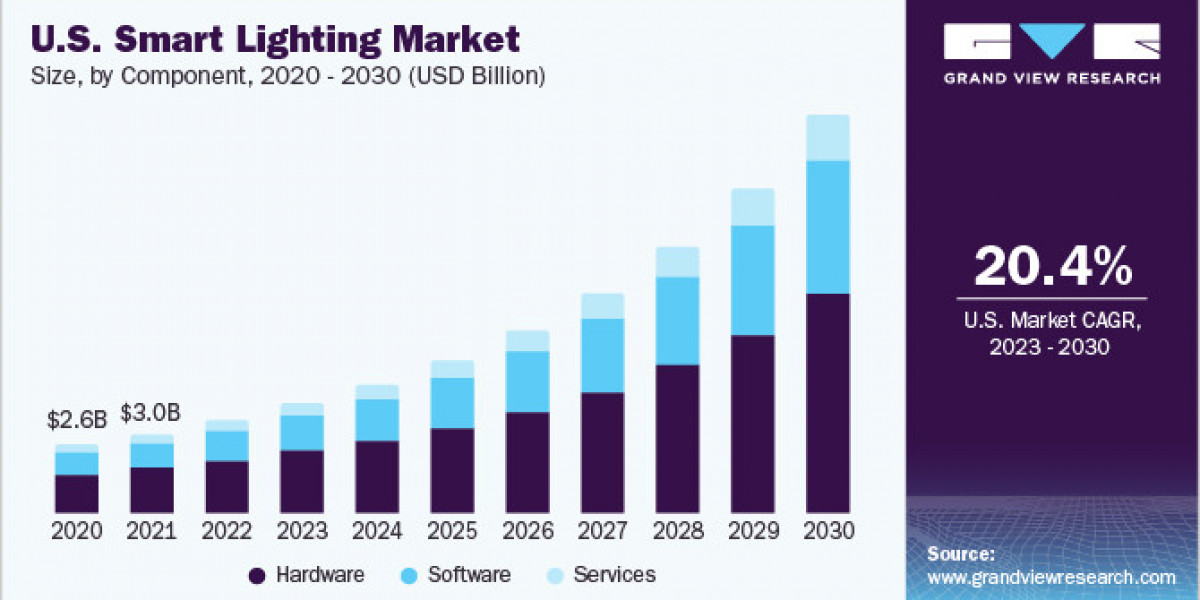

Component Insights

The smart lighting market is categorized into three main components: hardware, software, and services. The hardware segment dominated the market with a revenue share of 56.9% in 2020. Within this segment, lamps and luminaires have been identified, with the lamp category showing significant growth potential from 2023 to 2030. The demand for hardware is driven by the popularity of connected lighting bulbs and fixtures capable of changing colors, dimming, and being controlled via devices like smartphones or tablets.

The software segment is anticipated to experience the fastest CAGR of 22.9% during the forecast period. The demand for smart lighting solutions is fueled by the increasing use of lighting for data-driven applications in critical sectors. Software applications are essential for each brand, enabling control of lights through smartphones or tablets and facilitating integration with smart platforms like Alexa, Cortana, and Siri for voice command functionality. The growing trend of creating ambient environments and collecting data in smart cities is expected to further enhance this segment's growth.

Connectivity Insights

The wired segment held the largest revenue share of 64.2% in 2022 and is forecasted to grow at the fastest CAGR of 21.8% during the forecast period. Wired connections are preferred for distances exceeding 30 feet, with Ethernet supporting connections up to 100 meters. Protocols such as DALI, DSI, and DLVP enable connectivity over distances exceeding 1000 feet. The increasing adoption of smart lighting in commercial and industrial sectors is a key driver for the demand for wired connectivity solutions.

Conversely, the wireless segment is also expected to grow significantly during the forecast period. Wireless connectivity is favored by consumers requiring control over shorter distances. Technologies such as Wi-Fi, Bluetooth, SmartThings, Z-Wave, and ZigBee facilitate connections between lighting fixtures and smartphone applications, allowing users to manage lighting functions. The residential sector primarily utilizes wireless technology to control luminaire colors and settings for aesthetic purposes within confined spaces.

Application Insights

The indoor segment accounted for the largest revenue share of 65.5% in 2022. This segment is further divided into residential, commercial, and industrial applications. The residential sector is projected to experience rapid growth due to the increasing popularity of smart bulbs and fixtures that allow users to customize lighting moods. Additionally, demand in commercial and industrial spaces is driven by the need for efficient lighting control, as office environments and warehouses often operate continuously and require consistent power supply. The integration of smart lighting systems with built-in sensors enables lighting to be utilized only where needed, based on detected movement, and can automatically adjust brightness in response to external light levels.

The outdoor segment is expected to grow at the highest CAGR of 22.8% during the forecast period. This segment is further categorized into highways and roadways, architectural applications, and others. Outdoor architectural applications encompass lighting for patios, gardens, exterior walls, and other outdoor areas of residential or commercial properties. The increasing demand for smart lighting solutions in outdoor settings is driven by the need for energy-efficient lighting and the monitoring of outdoor activities. This trend is particularly evident in smart street lighting projects, where governments have invested in LED-based systems integrated with cameras and sensors to capture and share data related to outdoor activity.

Order a free sample PDF of the Smart Lighting Market Intelligence Study, published by Grand View Research.