Day trading cryptocurrencies successfully hinge on choosing the right indicators to navigate the volatile markets effectively. Understanding what indicators to use for day trading crypto is crucial for making informed decisions and maximizing profitability.

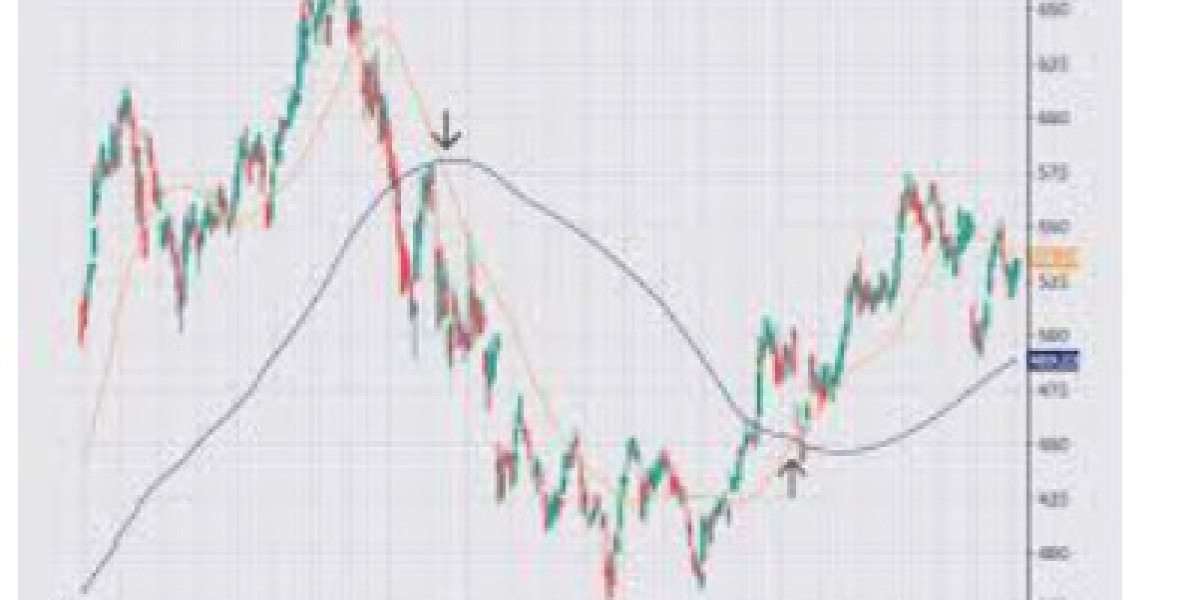

One of the fundamental indicators for day trading crypto is the Moving Average. Traders often rely on both the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) to gauge trend direction and identify potential entry or exit points based on historical price movements over specific periods.

The Relative Strength Index (RSI) holds significant importance as well. This indicator measures the speed and change of price movements, helping traders determine whether a cryptocurrency is overbought or oversold. It provides insights into potential price reversals or continuations.

Bollinger Bands are widely utilized by crypto day traders to assess price volatility. These bands, which consist of a central moving average line and upper and lower bands based on standard deviations, help identify potential breakout or breakdown points in the market.

The Moving Average Convergence Divergence (MACD) is renowned for its ability to capture changes in trend momentum. By comparing two moving averages, the MACD generates signals that highlight shifts in market sentiment, aiding traders in making informed decisions about when to enter or exit trades.

Lastly, trading volume is a critical indicator in crypto day trading. High trading volume often accompanies significant price movements, confirming trends identified by other indicators and providing additional validation for trading decisions.

Selecting indicators for day trading cryptocurrencies involves understanding each indicator's purpose, strengths, and limitations. Traders should choose indicators that align with their trading style, risk tolerance, and market conditions. By integrating these indicators into a cohesive trading strategy, traders can enhance their ability to analyze market trends, identify profitable opportunities, and manage risk effectively in the dynamic world of cryptocurrency trading.