Europe's Investment Management Regulatory Reporting market plays a crucial role in the financial landscape, serving as the bedrock for transparent and compliant financial operations within the investment management industry. This market is an intricate ecosystem where regulatory reporting requirements intersect with the nuanced needs of investment management firms, creating a dynamic environment shaped by evolving regulatory frameworks and industry demands.

??? ? ???? ?????? ??????:https://www.metastatinsight.com/request-sample/2565

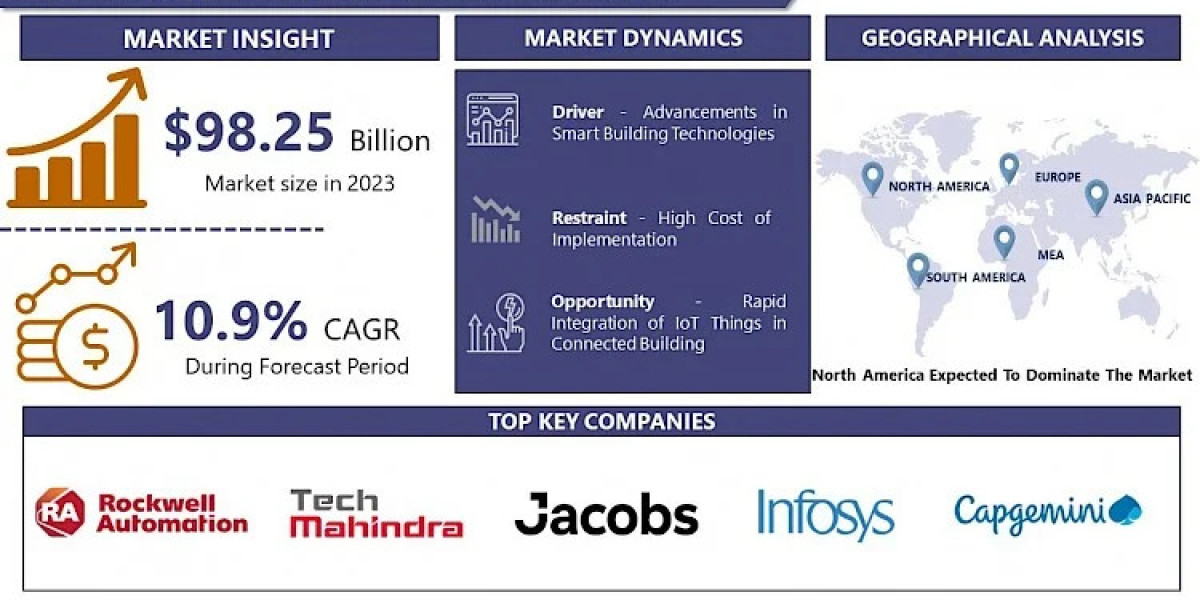

Top Companies

- BNP Paribas Securities Services

- BNY Mellon Investment Management

- Broadridge Financial Solutions, Inc.

- CACEIS (Crédit Agricole)

- Confluence Technologies, Inc.

- FactSet Research Systems Inc.

- Infosys Limited

- Adenza

- PricewaterhouseCoopers International Limited (PwC)

- SimCorp A/S

- SS&C Technologies Holdings, Inc.

- State Street Corporation

- Waystone

- MSCI Inc.

- S&P Europe Market Intelligence

The Europe Investment Management Regulatory Reporting market is the epicenter of regulatory compliance for investment management entities across the continent. With an ever-changing regulatory landscape, investment management firms are compelled to navigate a complex web of reporting obligations, ranging from MiFID II to AIFMD and beyond. The market functions as a conduit, translating these regulatory mandates into actionable reporting processes that ensure adherence to legal requirements.

Access Full Report @https://www.metastatinsight.com/report/europe-investment-management-regulatory-reporting-market

Moreover, the market serves as a hub for technological innovation within the investment management sector. As regulatory requirements become more intricate, the need for sophisticated reporting solutions has surged. The industry has responded with cutting-edge technologies such as artificial intelligence, machine learning, and automation, empowering investment management firms to enhance the efficiency and accuracy of their reporting mechanisms.

One of the key challenges addressed by the Europe Investment Management Regulatory Reporting market is the harmonization of reporting standards across different jurisdictions. As investment management firms operate across borders, the market facilitates the alignment of reporting practices, ensuring a standardized approach that meets the diverse regulatory expectations of European countries.

The ecosystem of the Europe Investment Management Regulatory Reporting market is populated by a diverse array of stakeholders, including regulatory technology (RegTech) providers, software developers, and consulting firms. These entities collaborate to deliver comprehensive solutions that cater to the multifaceted needs of investment management firms, offering not just compliance but also strategic insights derived from the data collected during the reporting process.

The Europe Investment Management Regulatory Reporting market is indispensable for the seamless functioning of the investment management industry in the face of evolving regulatory landscapes. By providing the tools, technologies, and expertise necessary to navigate these challenges, the market ensures that investment management firms can not only meet their reporting obligations but also derive valuable insights from the data they generate, contributing to a more resilient and adaptive financial ecosystem in Europe.

Europe Investment Management Regulatory Reporting market is estimated to reach $486.5 Million by 2031; growing at a CAGR of 6.6% from 2024 to 2031.

Contact Us:

https://www.metastatinsight.com

inquiry@metastatinsight.com

+1 214 613 5758