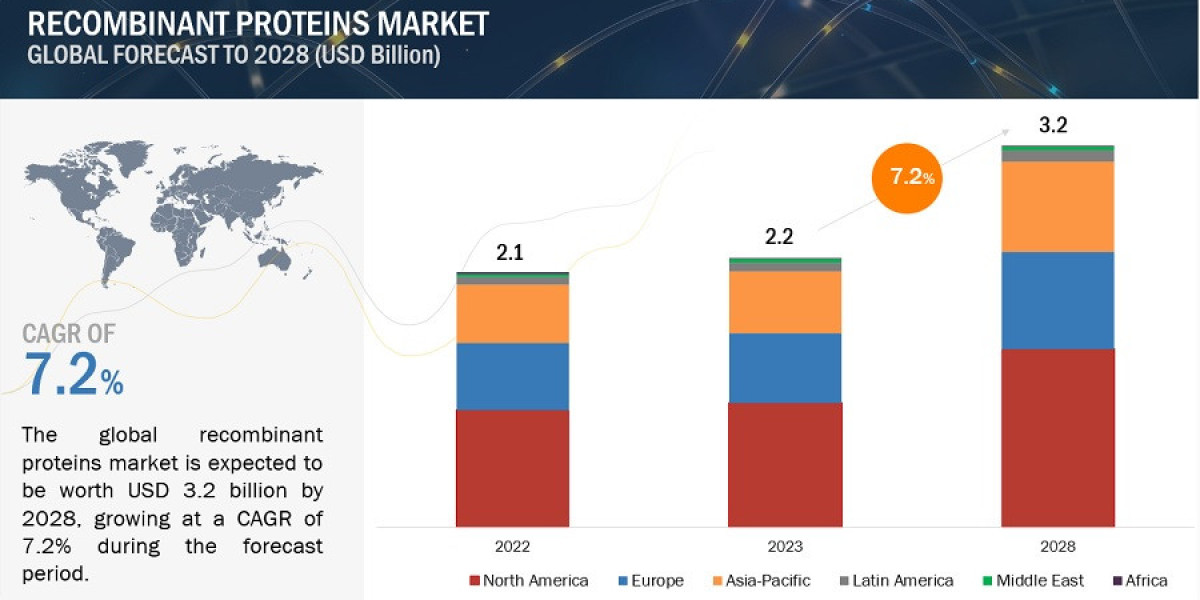

The global Recombinant Proteins Market in terms of revenue was estimated to be worth $2.2 billion in 2023 and is poised to reach $3.2 billion by 2028, growing at a CAGR of 7.2% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in the market can be attributed to factors such as rising incidence of chronic diseases, growing demand for biologics and biosimilars due to expiration of patents, rising demand for customized medicine and increasing government initiatives for R&D in life sciences research.

Download a FREE Sample Copy of the Global Recombinant Proteins Market Research Report at https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=70095015&utm_source=Ganesh&utm_medium=P

Key players in the recombinant proteins market include Bio-Techne (US), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Abcam plc (UK), Abnova Corporation (Taiwan), BioLegend Inc (US), Bio-Rad Laboratories, Inc. (US), BPS Bioscience, Inc. (US), Enzo Biochem Inc. (US), GenScript (China), Miltenyi Biotec B.V. & Co. KG (Germany), Proteintech Group, Inc. (US), Sino Biological Inc. (China), ACROBiosystems Group (US), Aviva Systems Biology Corporation (US), Sartorius CellGenix GmbH (Germany), Icosagen (US), Neuromics (US), ProSpec-Tany TechnoGene Ltd. (Israel), ProteoGenix S.A.S (France), RayBiotech Inc. (US), Laurus Bio (India), Stemcell Technologies Inc. (Canada), StressMarq Biosciences Inc. (Canada) and United States Biological (US).

This report categorizes the recombinant proteins market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Growth Factors and Chemokines

- Interferons (IFNs)

- Interleukins (ILs)

- Other growth factors & chemokines

- Immune Response Proteins

- Structural Proteins

- Membrane Proteins

- Kinase Proteins

- Regulatory Proteins

- Recombinant Metabolic Enzymes

- Adhesion Molecules and Receptors

- Other Recombinant Proteins

By Application

- Drug Discovery & Development

- Biologics

- Vaccines

- Cell & Gene Therapy

- Biopharmaceutical Production

- Research

- Academic Research

- Biotechnology Research

- Diagnostics

- Other Applications

By Host cell

- Mammalian Systems

- Insect Cells

- Yeast & Fungi

- Bacterial Cells

- Other host cell

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Academic Research Institutes

- Contract Research Organizations

- Other End Users

Inquire Before Buying at https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=70095015&utm_source=Ganesh&utm_medium=P

Global Recombinant Proteins Market Dynamics

Driver: Rising incidence of chronic diseases

The rising prevalence of chronic diseases has ultimately driven the demand for precise & effective protein therapeutic interventions.. The American Cancer Society estimates the number of new cancer cases and deaths each year, with common types including lung, breast, colorectal, prostate, and skin cancers. Various factors contribute to cancer risk, including tobacco use, poor diet, lack of physical activity, excessive sun exposure, and exposure to certain chemicals and pollutants. Breast, lung and bronchus, prostate, and colorectal cancers account for almost 50% of all new cancer cases in the United States. Lung and bronchus, colorectal, pancreatic, and breast cancers are responsible for nearly 50% of all deaths. For instance, in 2022, there were ~1.9 million new cancer cases diagnosed; of which 609,360 individuals died in the US as per the American Cancer Society. Cancer is the second most common cause of death in the US. In 2022, an estimated 89,010 new cases of lymphoma were diagnosed in the US.

Restraint: High production costs

Advancements in recombinant DNA technologies have opened avenues for the production of therapeutic, vaccine, and diagnostic recombinant proteins. These proteins are predominantly manufactured using prokaryotic & eukaryotic expression host systems, including mammalian cells, bacteria, yeast, insect cells, and transgenic plants, both in laboratory and large-scale settings. However, the high production costs associated with recombinant proteins stem from a multitude of factors across the production pipeline. Upstream processes, comprising cell culture & fermentation, requires considerable resources for large-scale production, including costly media, equipment, and facility maintenance. The development of efficient bioprocessing strategies is crucial for industrial production of recombinant proteins of therapeutic and prophylactic importance. Several initiatives are being opted to reduce the overall production cost burden. For instance, in February 2023, Future Fields (Canada) raised USD 11.2 million to expand its fruit fly biomanufacturing platform for the production of recombinant proteins

Opportunity: Advancements in gene editing technologies

Gene editing technologies are increasingly playing a crucial role in the development & optimization of recombinant proteins. These technologies empower researchers to make precise modifications to the genetic code, providing a method to enhance the expression, stability, and functionality of proteins produced using recombinant DNA technology. CRISPR-Cas9, TALENs (Transcription Activator-Like Effector Nucleases), ZFNs (Zinc Finger Nucleases), Base Editing, and Prime Editing are commonly used technologies utilized in the development & optimization of recombinant proteins. Of these, CRISPR-Cas9 is an extensively employed technique utilized to edit the genomes of various organisms used in protein expression. This technology allows researchers to intricately modify the genomes of host cells designated for protein expression, facilitating a spectrum of optimizations. For instance, it has been observed that CRISPR-Cas9 technique coupled with HEK293 cells is used to establish a stable recombinant proteins production cell line, ultimately increasing the industrial potential of human-derived cell hosts as per the Carnegie Mellon University (Qatar).

Challenge: Challenges associated with delivery systems

Development of an efficient delivery system for recombinant proteins presents a challenge in biotechnology & medicine. Biological barriers, such as cellular membranes and mucosal or blood-brain barriers, pose obstacles to effective protein delivery. Key considerations include overcoming biological barriers, maintaining protein stability, achieving target specificity, reducing immunogenicity, and controlling dosage. Biological barriers, such as cellular membranes and mucosal or blood-brain barriers, pose obstacles to effective protein delivery.

Direct Purchase of the Global Recombinant Proteins Market Research Report at https://www.marketsandmarkets.com/Purchase/purchase_reportNew.asp?id=70095015&utm_source=Ganesh&utm_medium=P

North America was the largest regional market for recombinant proteins industry in 2022.

The recombinant proteins market is segmented into six major regions namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa. In 2022, North America accounted for the largest share of the market, and this trend is expected to continue during the forecast period. Presence of prominent market players, a surge in chronic and infectious diseases, rising R&D expenditure, growing research initiatives in proteomics and genomics, and favorable government funding opportunities collectively are major factors contributing to the growth of market.